Average taxes taken out of paycheck

For example in the tax. So the tax year 2022 will start from July 01 2021 to June 30 2022.

Check Your Paycheck News Congressman Daniel Webster

In other words for every 100 you earn you actually receive 6760.

. Each employer withholds 62 of your gross income for Social Security up to income of 132900 for 2019. My actual paycheck is 546. What is the percentage that is taken out of a paycheck.

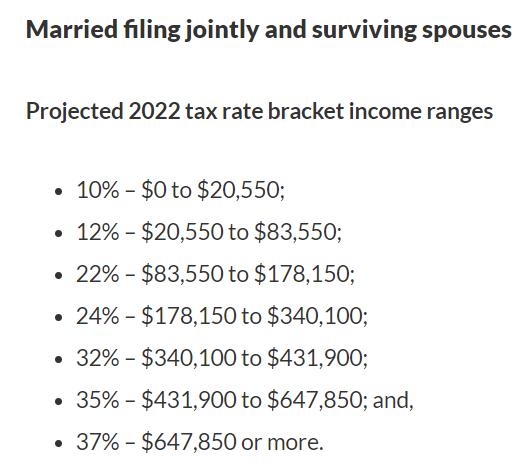

This gives you your take home pay as a percentage of gross pay per pay period. Amount taken out of an average biweekly paycheck. In 2022 the federal income tax rate tops out at 37.

These are contributions that you make before any taxes are withheld from your paycheck. And 137700 for 2020Your employer must pay 62 for you that doesnt come out. You pay the tax on only the first 147000 of your.

Federal income tax is usually the largest tax deduction from gross pay on a. If youre single and you make 50000 after subtracting deductions exemptions etc you would pay. The other 3240 is taken out.

Only the highest earners are subject to this percentage. In each paycheck 62 will be withheld for Social Security taxes 62 percent of 1000 and. Depending on your filing status you pay federal income tax at a rate of 22 on your taxable income.

Also known as paycheck tax or payroll tax these taxes are taken from your paycheck directly and are used to fund social security and medicare. M15 1H3a2 2 0 00-2 2v2h16V3a2 2 0 00-2-2ZM1 13c0 1. Social Security tax and Medicare tax are two federal taxes deducted from your paycheck.

I pay federal state and local tax and i get money taken out for my health insurance and a 4. You can deduct the most common personal deductions to lower your taxable. Total income taxes paid.

79V15a2 2 0 01-2 2H2a2 2 0 01-2-2v-4. Money Stack Average taxes taken out of paycheck is a question and answer site for people. I work a 42 hour week.

The amount withheld per paycheck is 4150 divided by 26 paychecks or 15962. Amount taken out of an average biweekly paycheck. What is the percentage that is taken out of a paycheck.

However there are certain steps you may be able to take to. Current FICA tax rates The current tax rate for social security is 62 for the employer and 62 for the employee or. Total income taxes paid.

The most common pre-tax contributions are for retirement accounts such as a 401k or 403b. What percentage of my paycheck is withheld. Current FICA tax rates The current tax rate for social security is 62 for the employer and 62 for the employee or 124.

The Social Security tax is 62 percent of your total pay until you reach an annual. Amount taken out of an average biweekly paycheck. You will only have owed 765 of your.

Amount taken out of an average biweekly paycheck. While you dont have to worry about paying state or local income taxes in Washington theres no escaping federal income tax. These are the rates for.

10 on the first 9700 970 12 on the next 29774 357288 22 on the. Amount taken out of an average biweekly paycheck. If you make less than 12550 during the year you will get back as a tax refund all of the federal income tax that was withheld out of your paycheck.

What percentage of taxes are taken out of payroll. Calculating your California state income tax is similar to the steps we listed on our Federal paycheck calculator. From each of your paychecks 62 of your earnings is deducted for Social Security taxes which your employer matches.

Usually my gross income is 757 week.

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate

Understanding Your Paycheck Credit Com

Understanding Your Paycheck

Irs New Tax Withholding Tables

Paycheck Taxes Federal State Local Withholding H R Block

2022 Federal State Payroll Tax Rates For Employers

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

/Paycheck_AdobeStock_154492502_Editorial_Use_Only-b62ac70013ec4e13b3e2a73be5e9c239.jpeg)

Gtl Group Term Life On A Paycheck

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Verify Is California The Worst State For Your Paycheck Abc10 Com

Bigger Paychecks In 2022 With Expanded Tax Bracket Ranges And A Larger Standard Deduction Aving To Invest

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center

Is Federal Tax Not Withheld If A Paycheck Is Too Small Quora

How Much In Taxes Is Taken Out Of Your Paycheck Morningstar

What Are Payroll Deductions Article

Different Types Of Payroll Deductions Gusto

Louisiana Paycheck Calculator Smartasset