Tax brackets for paychecks

All you need to do is enter payroll data. Easily manage tax compliance for the most complex states product types and scenarios.

Tying The Knot Sometimes Means Paying A Marriage Tax Penalty

10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent.

. Many workers noticed changes to their paychecks starting in 2018 when the new tax rates went into effect. This is great for comparing salaries reviewing how. Your 2021 Tax Bracket To See Whats Been Adjusted.

Federal Paycheck Quick Facts. Easily manage tax compliance for the most complex states product types and scenarios. Get Guidance in Every Area of Payroll Administration.

Ad Accurately file and remit the sales tax you collect in all jurisdictions. Effective 01012018 Single Person including head of household SUBTRACT 15960. For example in the tax year 2020 Social Security tax is 62 for employee and 145 for Medicare tax.

We speak tax in 35 languages natively. If you compute payroll manually your employee has submitted a Form W-4 for 2020 or later and you prefer to use the Wage Bracket method use the worksheet below and the Wage Bracket. The tax calculator can be used as a simple salary calculator by entering your Weekly earnings choosing a State and clicking calculate.

Simplify Your Day-to-Day With The Best Payroll Services. Or call us at 901-360-0711 and we will walk you through the process over the phone to help you enter the data and provide that extra level of comfort. If your monthly paycheck is 6000 372 goes to Social Security and.

Ad Clients In 50 Countries. This is roughly half of what you paid as an employee paid. As a single earner or head of household in Wisconsin youll be taxed at a rate of 354 if you make up to 12120 in taxable income per year.

Our clients lower their global effective tax rate and reduce risk. For taxable wages over 503 and not over 1554 a tax rate of 15 percent plus a flat rate of 3430 applies to wages over 503. Ad Choose From the Best Paycheck Companies Tailored To Your Needs.

Tax Bracket If youre single and you make 50000 after subtracting deductions exemptions etc you would pay. Median household income in 2020 was 67340. If youre self-employedas a sole.

Discover Helpful Information And Resources On Taxes From AARP. Ad Accurately file and remit the sales tax you collect in all jurisdictions. The top marginal income tax.

1 day agoIn most cases the federal payroll tax rate is about 153 with the employee covering 765 and the employer covering 765. The remainder is subject to withholding tax at the rate in the appropriate section below. 10 on the first 9700 970 12 on the next 29774.

What Are the Trump Tax Brackets. There are seven federal income tax rates in 2022. Ad Compare Your 2022 Tax Bracket vs.

Ad Expert Analysis Practical Guidance and Tools All on One Easy-to-Use Platform. Federal income tax rates range from 10 up to a top marginal rate of 37. Singles and heads of household making.

2022 Income Tax Withholding Tables Changes Examples

Pin On Startup

Credit Scores 101 Understand Exactly What Goes Into The Calculation With This Easy Visual And Get Step By Step I Credit Score Fico Credit Score Fix My Credit

State Of Michigan Payroll Schedule Image Payroll State Of Michigan Sales Techniques

There S Free And Then There S Me As Your Tax Preparer I Promise To Offer A True Concierge Tax Experience I Make I Tax Money Tax Preparation Turbotax

Finals Week Behold Power Coffee Postcard Zazzle Finals Week Postcard Coffee Poster

Untitled Labor Law Instagram Posts Paycheck

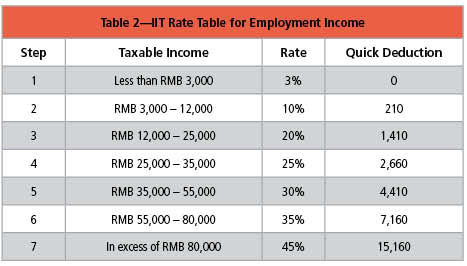

What You Need To Know About Payroll In China

Pin On Accounting Hub

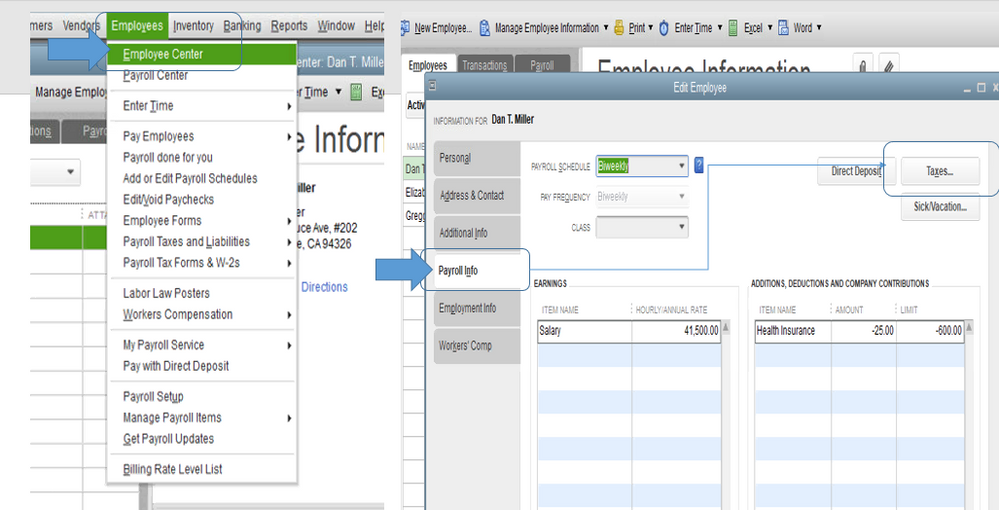

How Much Does Quickbooks Payroll Cost Per Year In 2022 Quickbooks Payroll Quickbooks Payroll

When Will The New 2018 Tax Laws Affect My Paycheck Tax Brackets Paycheck How To Plan

A Friend Sent This To Me I Cannot Say That It Is True Or False But It Certainly Is Worth Looking Into Payroll Taxes Income Tax Brackets Social Security Card

Employee Paid City Taxes Adding Exemption To Payroll Item

Tax Depreciation Schedules Australia Gives An Idea About Invest Property And Houses Through Taxes Depreciation For Particula Tax Services Tax Season Income Tax

Pin On Networking Links In The Dmv

How Much Does A Small Business Pay In Taxes

Pin On Accounting Hub